What are accounting and its importance

What is Accounting?

This is the process that records the Financial Aspects. The accounting process keeps information in writing about the financial transactions happening in any organization or business.

There is as much science in accounting as there is art. It records, categorizes, and categorizes money transactions, prepares their summaries, and presents them so that they can be analyzed or interpreted.

Accounting serializes all the transactions related to a particular head. Account or account refers to a summary record of transactions relating to any person or thing. For example: When an entity transacts with different suppliers and consumers, each supplier and consumer will have a separate account.

The account can be related to anything tangible and intangible such as land, buildings, furniture, etc. The left-hand side is called the debit ('Dr') side, while the right hand is called the credit ('Kr') side.

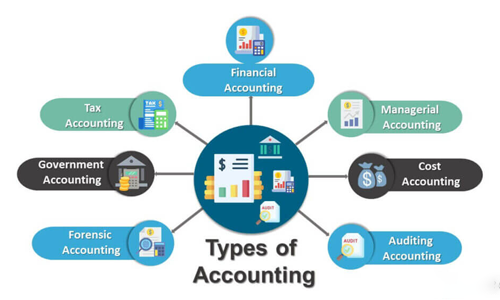

What are the Main Three Types of Accounting?)

There are three main types of accounting:

Personal Account

The accounts associated with any person, organization, or company are called Personal Accounts. For example, the personal account of a person named Mohan will be called a personal account (eg. – Mohan's Account. The following accounts come under personal account:

someone's account

bank account

capital account

Supplier or customer account

Financial and institution account

drawing account

XYZ limited account etc.

This is all contained in the personal account, which gives us a sense of who to take money from or who to give money to. Personal Accounts:

Debit is the receiver.

Credit is Giver.

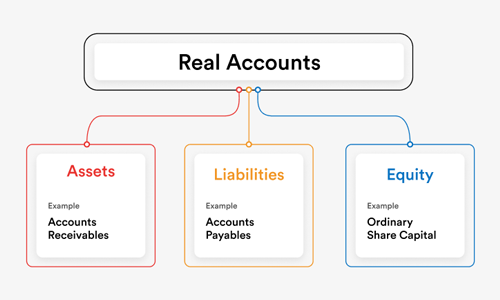

Real Account

A real Account or real Account is related to the object or property. Information related to assets (goods and services) and liabilities, i.e., debt or debt, is available through the existing account. Natural accounts are of the following types:

Tangible Real Accounts:

These include assets that have physical existence and can be touched. for example -

Land account

building account

Machinery account

furniture account

Vehicles Account

Intangible Real Accounts:

These assets have no physical existence and cannot be touched. However, these can be measured in terms of money and can have value. for example -

Goodwill account

Patent account

copyright account

Trademark account etc.

Rule of Real Account:

Debit is what comes in business.

Credit is what goes out of business.

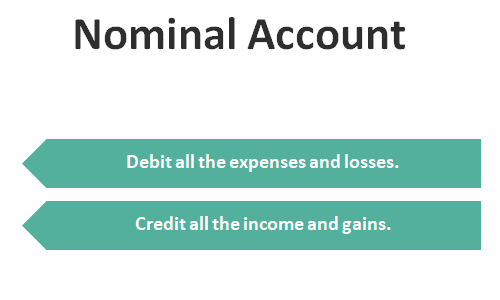

Nominal Account

Information about income and expenses is available in the Nominal Account. The nominal account holds the information related to our profit or loss.

Rule of Nominal Account:

Debit all business expenses and losses

Credit is business income and profit

Nominal accounts are of the following types:

discount account

Salary account

Purchase account

Interest account

Wages Account

Commission pay or receive account

sales account etc.

insurance account

Apart from these three accounts, there are some other types:

Cash Account:

This account keeps records of payments made by cash, withdrawal, and deposit.

Income Account:

The purpose of this account is to keep a record of the income sources of the business.

Expense Account:

This account tracks the expenses of the business.

Liabilities Account:

If there is any debt or debt, then that amount comes under liabilities.

Equity Account:

Earnings are retained if the account is owned by the owner or investment of common shares, then these come under equity.

Some special terms of accounting (Important terms used in accounting)

Traders need to understand some unique words of accounting, such as:

1. Accounts Payable (AP)

It includes all expenses that a business has incurred but not yet paid for. This account is recorded as a liability on the balance sheet as it is a debt owed by the company.

2. Accounts Receivable (AR)

This includes all sales made by a company, but payment has not yet been collected. This account is on a balance sheet, recorded as an asset that will be converted into cash over the coming days.

3. Accrued Expense

Expenses have not been paid but are described by the term Accrued Expense.

4. Asset (A)

Anything owned by the company that has monetary value. These are listed in order of liquidity from cash (most liquid) to land (least liquid).

5. Balance Sheet (BS)

A financial statement that reports on all assets, liability, and equity of a company. A balance sheet equation can settle this-

<Assets = Liabilities + Equity>.

6. Book Value (BV)

Once an asset is depreciated or reduced in value, it loses value. Book value refers to the original value of an investment.

7. Equity (E)

Equity refers to the value left after liabilities are removed. Remember its equation – Assets = Liabilities + Equity. If you take your assets and reduce your liabilities, you are left with equity, which is the part of the company claimed by the investors and owners.

8. Inventory

Inventory is a term used by a company to classify the assets it has bought and sold to customers that remain unsold. The inventory account will decrease as these items are sold to customers.

9. Liability (L)

All debts that the company has paid so far are liabilities. Joint liabilities include Payable, Payroll, and Loans.

10. Expense (Cost)

Expense is any cost incurred by the business.

11. Cost of Goods Sold

The cost of goods sold is associated with the product or service of goods. Not included in this category are the required costs to run the business.

12. Gross Margin (GM)

A percentage calculated by taking gross profit and dividing it by RevenueRevenue for the same period is called gross Margin. It shows a company's profitability after deducting the cost of goods sold.

13. Gross Profit (GP)

Gross profit indicates a company's profitability without taking into account overhead expenses. It is calculated by deducting the cost of goods sold for the same period.

14. Net Income (NI)

Net income is an amount that is earned from profit. Ye is calculated by subtracting shared expenses like COGS, Overhead, Depreciation, Taxes, etc., from RevenueRevenue to our provision.

15. Net Margin

Net Margin is the amount that shows the profit related to a company's RevenueRevenue. It is calculated by taking net income and dividing it by RevenueRevenue for a given period.

16. Revenue (Sales) (Rev)

Revenue is any money earned by the business.

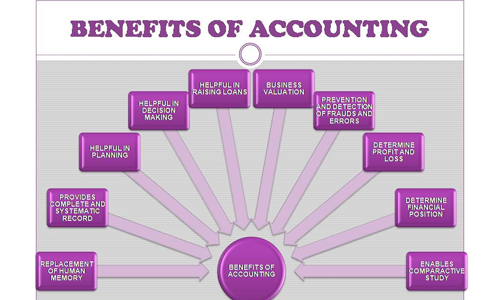

Benefits of accounting:

1. It is difficult for a person to remember all the things, which also increases the chances of making mistakes. There are hundreds of thousands of transactions in business every day. Many things are dealt with. These can be both cash and credit. Wages, Salary, Commission, etc., payments are made in the form. It is not possible to remember all of them. Accounting removes this lack.

2. Many news related to accounting business reaches us quickly, such as:

Profit and loss information

credit balance information

assets and loan information

Business turnover, economic conditions, etc. information of

3. Accounting records can be presented as evidence in court in case of payment problems from other merchants in money transactions.

4. Helps in the calculation of problems related to salary, bonus, allowances, etc. of employees

Why should your company adopt accounting software?

What is accounting, the types, advantages of accounting software, and some unique things related to accounting?

NTRO: Earlier, people used to manage all these things manually, due to which there was a risk of system loss due to mistakes, i.e., account loss or errors in accounting. System loss due to paper maintenance has been reduced with the advent of accounting software. Everyone has started doing accounting software in every business, from small to big.

Accounting software solutions can help businesses in many ways, and today we'll give you concrete reasons why and how you should start using it to grow your business. First, it is essential to understand what accounting is (what is accounting?).

What is accounting software, and what does it do?

Accounting software is application software that does everything needed in an accounting business but in a digital way. Accounting software evaluates and takes care of the financial position of a company.

This software, like an accounting information system, takes care of some essential calculations and documents related to your business:

Your accounts: Maintaining accounts is the primary function of accounting software. It takes care of accounts payable and accounts receivable, helps you in banking-related work, gives you all the expenditure, income, loan (liabilities), and shows the assets.

Invoices and Bills: Bills and invoices are another significant financial part of a business. Accounting software helps you provide invoices to customers and generate bills for them.

Tracking Sales: Along with invoices and bills, the system tracks total sales.

Payroll Management: Accounting software also manages employees. It takes care of their salary, wages, bonus, and financial compensation.

Inventory Management: Inventory management is essential for business. The stock management situation becomes even better by implementing this solution.

Reporting Tax: Apart from making a comprehensive financial report, it takes care of tax management.

Helping in budgeting: It analyzes the documents at hand, compares them with the previous ones, and helps make new budgets.

5 advantages of adopting accounting software (importance of accounting in Hindi)

Accounting software brings a lot of benefits to your business by simplifying the day-to-day calculations such as:

A good accounting software system saves a lot of time compared to manual bookkeeping.

Manual accounting increases the likelihood of errors. Accounting software minimizes mistakes.

Leading accounting software system provides advanced features such as a salable database and sophisticated customization. With the expansion of startups and small businesses, accounting software is very beneficial in meeting their growing needs and demands.

Automated solutions like this software are straightforward to learn. Not much time is spent learning it. With this, you can generate digital invoices, manage cash flow according to your needs and even keep track of your inventory very easily.

Accounting platforms can calculate the tax amount to be paid on each invoice. This makes tax reporting more straightforward.

How To Choose Accounting Software For Your Company? (How to choose accounting software for your business?)

With the rapidly changing times, many solutions are coming into the market. All accounting softwares have its advantages and disadvantages. So while choosing any software system for your company, it is crucial to search bin and make a better decision to know which accounting software is best for you – online or offline.

What is better between offline accounting software and online accounting software? (What is offline accounting software, and what is online accounting software?)

Based on technology, there are two types of accounting software:

Offline: A traditional PC based technology, ACE can be installed from CD,

Online: Advanced technology, cloud, and internet-based allowing online access anytime, anywhere.

Offline softwares are set by default, and if they have to be changed, then the whole configuration has to be changed, which reduces the flexibility. To better understand offline and cloud-based accounting software, we should understand more deeply about online and offline accounting software.

What are the advantages or disadvantages of offline accounting software? What are the disadvantages of offline or essential accounting softwares?

Here are 8 disadvantages that can help you make better decisions:

The cost of installation of offline accounting software or an ERP system is expensive. And ERP consultants are costly and take up to 60% of the budget.

For such software pay accounting, your company must have employees who are well versed with the software. If it is not, it may be a failure or add to the cost of training the employees to acquire the skills.

To work with such offline and traditional software, if the employees of different departments are apprehensive about sharing the information of their department with any other department and such information is not complete.

Need to download it every time there is any change in GST rules

POS and accounting are not linked in such software.

Sales Management (CRM Invoicing etc.) is not linked.

There is a risk of losing data in essential offline accounting software because the data in the computer is saved without any backup. If there is any problem with the PC or if the PC fails, then the data will be lost by chance.